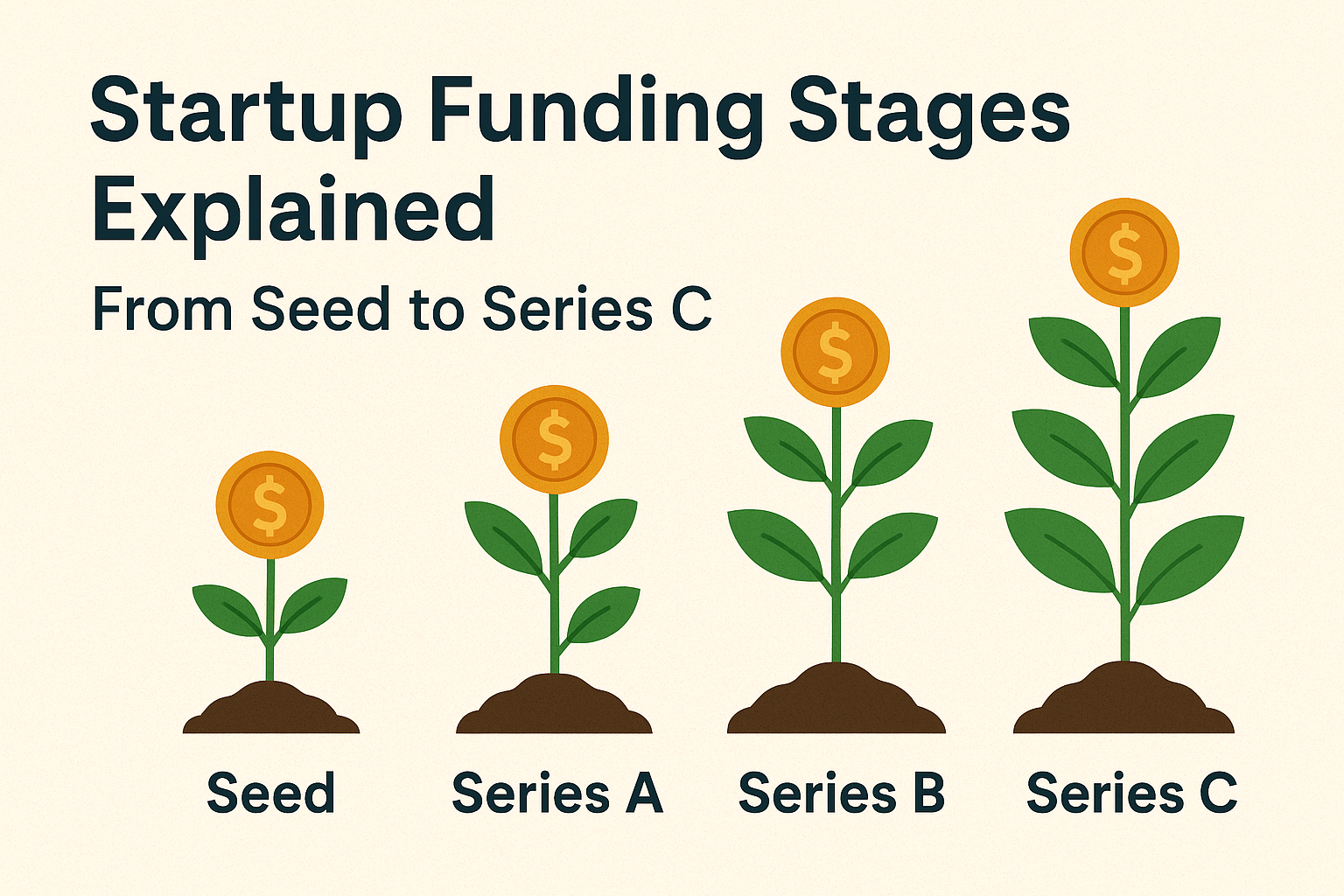

In the initial years, startups cannot survive solely on revenue. And so, they seek external investment through funding rounds.Each of the startup funding rounds: Seed, Series A, B, C, D are stages of growth and investor confidence.

In this blog, you will explore startup financing stages, investment stages, seeds vs series, difference between different series types i.e. A, B and C, what each one means in detail, and many more.

What are Startup Funding rounds?

For expansion, operations and growth of startups, they raise money from investors through seed serie funding rounds. These rounds are structured and follow a progression which is from seed funding to series A, series B funding and ends with series C funding.

In brief, funding rounds revolve around early rounds and later rounds. In the early rounds like seed round funding investors take bigger risks as the business is new, hoping to get higher returns. In later stages like series B and series C, as the business is established, businesses invest in more money to scale up their business.

Stages of Funding for a Startup:

1. Pre-Seed funding:

Where the purpose and goal is to turn an effective idea into a real product. The money raised in this stage is generally from founders, friends or family. The founders, close contacts and angel fund investors are those who invest during this stage. The funding size is usually between $50K–$500K. During pre-seed funding the business is just starting out, building a prototype or a Minimum Viable Product (MVP).

2. Seed Funding:

Seed stage startup is where the business has started, MVP is developed and first customers have onboarded. The purpose of this stage is to test the products and see if they are fit for the market and also to build a small but effective team. Angel investors, seed funding and sometimes Venture Capital firms invest in startups during this stage. The Funding size is between $500K–$2M.

3. Series A funding:

In this stage (seed a funding or series A) , the products of the startups are proven to be a market fit, the customer base is growing and the revenue is also much higher than previous stages. The purpose is to expand the team, refine monetization strategies, etc. Venture capital firms and institutional firms are the investors. Funding size is between $2M–$15M.

4. Series B Funding:

This stage is about moving from a growing startup to a business (startup B) that can dominate the market. Funds are used to expand geographically, increase production or enhance technological infrastructure. Large Venture capital firms, corporate investors and private equity firms are the ones investing and funding size is between $15M–$50M but can be higher as well.

5. Series C Funding:

In this stage, business is more established with higher revenue and customers. The purpose is to reduce risk, increase growth, expand globally or prepare for an IPO (Initial Public Offering). Late stage Venture Capital firms, investment banks, private equity firms, etc are the investors and the funding size is $50M–$200M+.

Why are Funding Stages Important?

Funding rounds aren’t just steps but they shape a startup’s or a business’ future. Here is why the startup funding stages are crucial for a business or a startup:

1. Milestone Based Growth:

Each round is different and focuses on different aspects and helps the founders to hit a key milestone in each stage.

a. Seed round for MVP and first customers

b. Series A funding for revenue traction

c. Series B for more market expansion

d. Series C for Global expansion

2. Investor Confidence:

Through each funding round businesses and startups make progress and that’s what an investor needs as a proof before they invest any money.

3. Risk Management:

Through various startup funding stages, instead of investing all the money at once, money is invested in rounds and stages and thus, it reduces the risk of loss.

4. Valuation Growth:

As the startups hit different milestones, their valuation increases which means that the founders give less equity in later stages as compared to the earlier stages.

5. Attracting talent and Partnerships:

Securing funds from Series A and Series B isn’t just about money but it also creates a huge difference. It gives a signal that the startup is more credible. Then, this makes it easier to hire talented individuals, win customers and get valuable partnerships.

Challenges at each stage:

1. Seed: It is hard to convince investors as it is just the beginning of the startup and you have very less to show them.

2. Series A: In this stage many startups fail as they are unable to show revenue growth.

3. Series B: The startups have pressure to scale up quickly and burn rate can get out of control.

4. Series C: The competition becomes tough and the investors want more efficiency and not just the growth of the startup

FAQ’s

1. What’s the difference between A, B, and C funding?

Ans: A basic difference between the three is that Series A funding is for revenue traction, Series B is for more market expansion, and Series C is for Global expansion

2. What is series A and B funding?

Ans: Series A focuses more on revenue traction and Series B focuses on more market expansion.

3. Why do startups raise money in stages?

Ans: This is because of the risk in each stage. Investors want proof that the company is credible which they see through funding stages

4. What happens after Series C?

Ans: Some go for Series D/E but most go for IPO’s or get acquired.