Financial literacy is no longer a “nice-to-have” skill—it’s a survival skill, especially for students. Many young people start earning, receiving pocket money, or handling scholarships without ever being taught how to manage money properly. As a result, savings disappear quickly, expenses go untracked, and financial stress begins early.

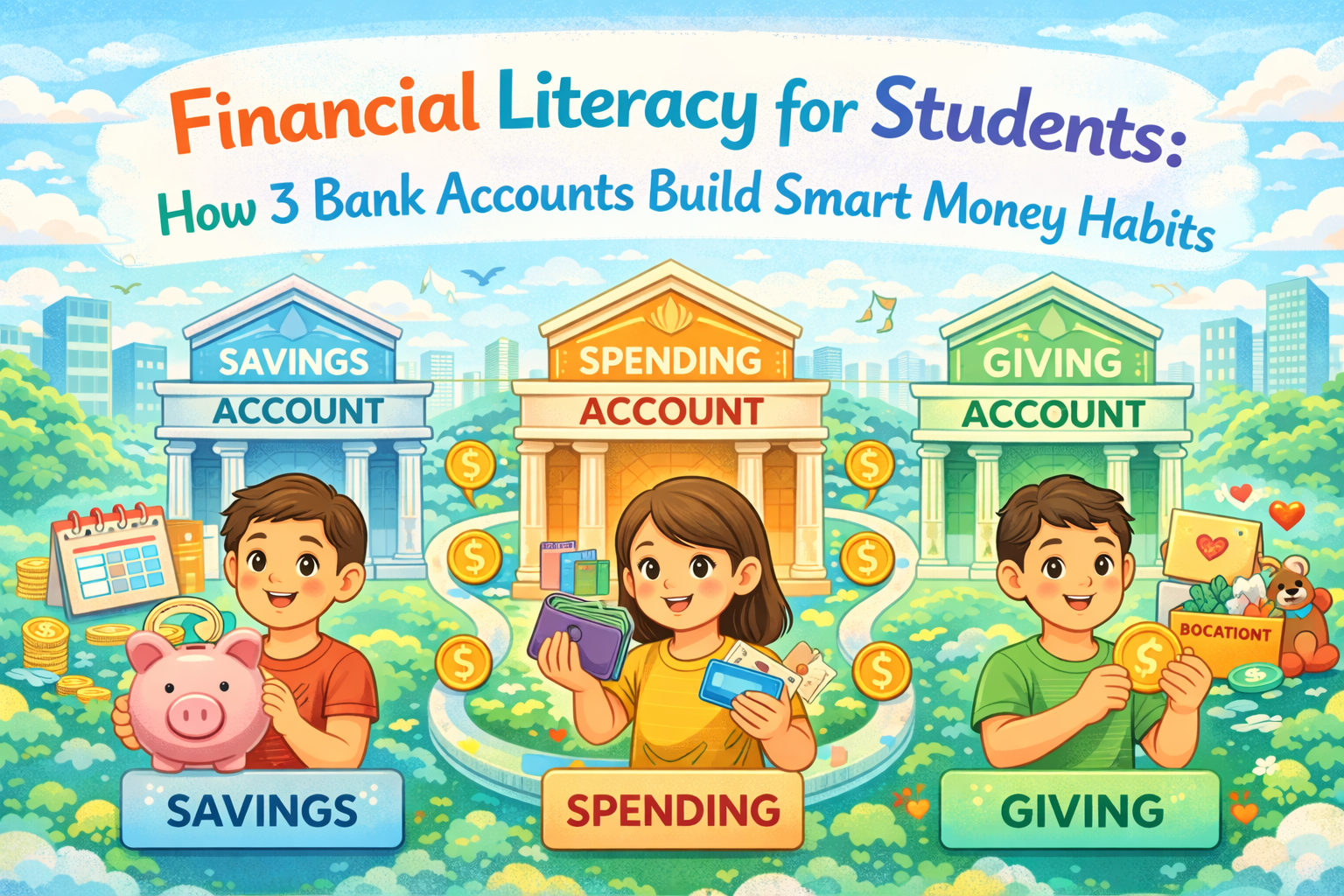

One simple yet powerful way students can build smart money habits is by using a 3 bank account system. This approach helps students organize their finances, avoid impulsive spending, and develop discipline that lasts well into adulthood.

Why Financial Literacy Matters for Students

Students today are exposed to digital payments, UPI apps, online shopping, and easy credit much earlier than previous generations. Without proper financial education, money becomes easy to spend but hard to manage.

Financial literacy helps students:

- Understand the value of money

- Learn budgeting and saving early

- Make informed financial decisions

- Avoid debt traps in the future

- Build confidence around income and expenses

Learning these skills while studying creates a strong foundation for future independence.

What Is the 3 Bank Account System?

The 3 bank account system is a simple method of dividing money into clear purposes instead of keeping everything in one account. Each account has a role, which reduces confusion and improves control.

The three accounts are:

- Spending Account

- Savings Account

- Growth or Investment Account

This system works whether a student receives pocket money, a stipend, or earns through part-time work or freelancing.

Account 1: Spending Account (Daily Use)

This account is for regular expenses like food, travel, phone bills, subscriptions, and small purchases. Students can decide a fixed amount to transfer here every month or week. Benefits:

- Prevents overspending

- Makes daily expenses visible

- Encourages budgeting

Once the balance is used up, spending stops—this naturally builds discipline.

Account 2: Savings Account (Security & Goals)

This account is meant strictly for saving. It should not be used for random shopping or emergencies unless truly required. Savings can be for:

- College needs

- Emergency funds

- Short-term goals

- Courses or skill development

Benefits:

- Builds a saving habit early

- Creates financial safety

- Reduces stress during unexpected situations

Even small monthly savings can grow into a strong habit over time.

Account 3: Growth or Investment Account (Future Focus)

This account is for learning how money grows. For students, this doesn’t mean risky investments—it means understanding the basics of financial growth. This account can be used for:

- Fixed deposits

- Mutual funds (long-term, beginner-friendly)

- Learning investments under guidance

Benefits:

- Introduces investing mindset

- Teaches delayed gratification

h Builds long-term thinking

This account helps students think beyond immediate needs and focus on the future.

How This System Builds Smart Money Habits

Using three accounts brings clarity. Instead of guessing where money went, students know exactly how much they can spend, save, and grow.

It helps students:

- Separate needs from wants

- Track income and expenses easily

- Reduce impulsive spending

- Become financially responsible early

Most importantly, it builds confidence around money—a skill many adults struggle with.

FAQs

1. Why should students learn financial literacy early?

Ans. Early financial literacy helps students avoid poor money decisions, manage expenses confidently, and build lifelong habits before earning full-time incomes.

2. Is the 3 bank account system suitable for students with low income?

Ans. Yes. Even small amounts can be divided. The system focuses on habits, not income size.

3. Do students really need an investment account?

Ans. It’s not mandatory, but it helps students understand how money grows and encourages long-term thinking.

4. Can students use digital wallets instead of bank accounts?

Ans. Bank accounts are safer and better for discipline. Wallets are best used only for spending, not savings or growth.

5. How much should a student save every month?

Ans. There’s no fixed rule. Even saving 10–20% of income or pocket money is a great start.

6. Does financial literacy help in career planning too?

Ans. Yes. Money awareness helps students choose courses, careers, and opportunities more realistically.