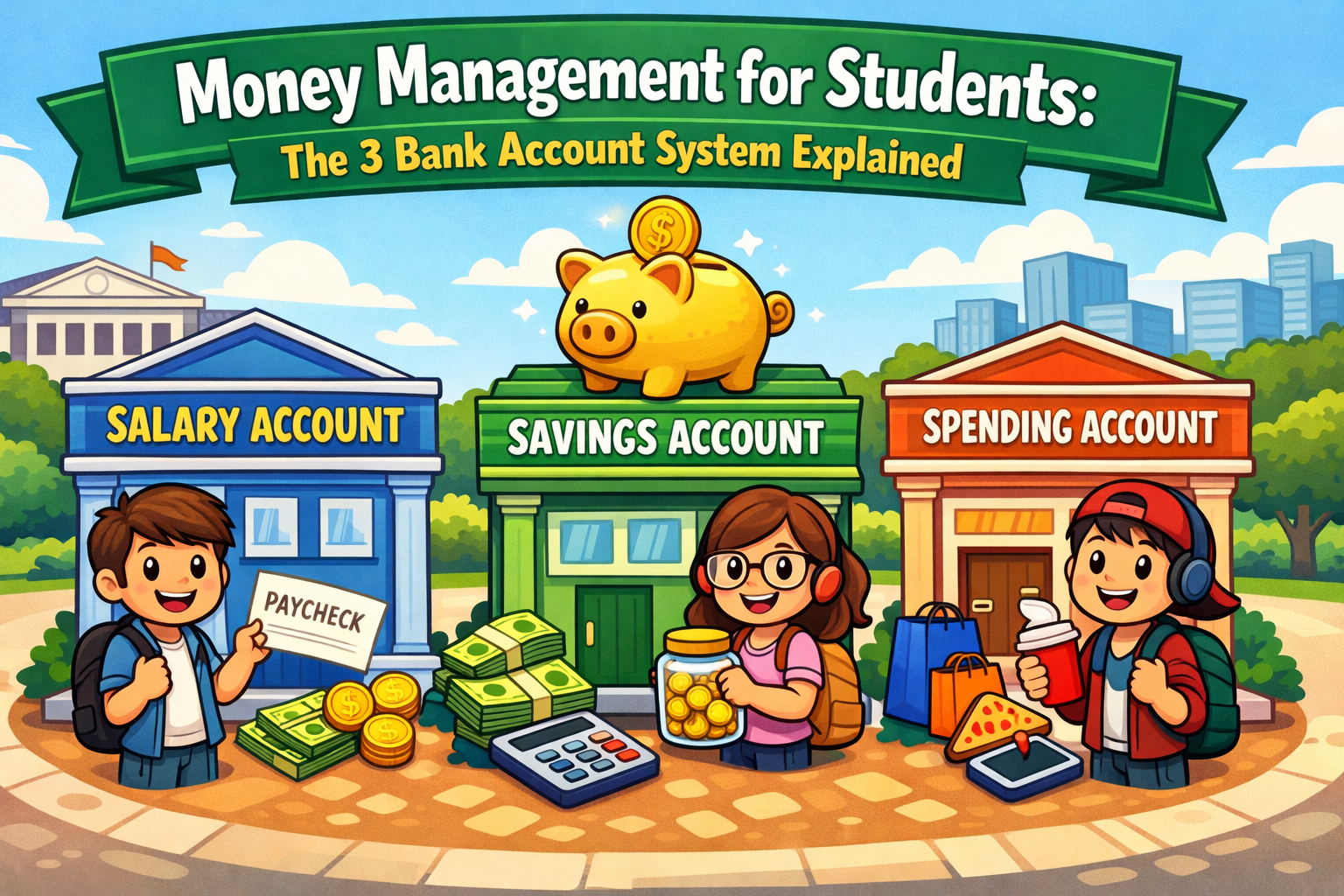

Being a student usually feels like a constant tug-of-war between wanting to grab a coffee with friends and staring at a bank balance that says otherwise. Most of the time, the struggle isn't about not having enough money, but rather not knowing where it all goes. It disappears into small, invisible leaks like subscriptions, late-night snacks, or impulsive online shopping. This is where the concept of Money management becomes a total game-changer. Instead of checking an app and feeling a mini heart attack every time a purchase is made, imagine having a system where every rupee has a specific job. Learning How to save money isn't about depriving oneself of fun; it’s about creating a roadmap so that both the needs and the wants are covered without the stress. Using a simple three-account strategy turns chaotic spending into a structured Cash flow that actually works for a student lifestyle.

The Logistics of the Three-Account Strategy

Setting up bank accounts for students doesn't have to be a headache. The idea is to move away from the "one big pile of money" approach and instead divide funds based on their purpose. When all the money stays in one place, it’s easy to overspend on things that aren't necessary. By splitting it up, the boundaries are clear.

➤Account 1: The Operating Hub (Expenses)

➝This is the primary Bank account used for the daily grind.

➝It covers essentials like rent, groceries, transport, and phone bills.

➝By keeping only what is needed for bills here, the risk of dipping into other funds is minimized.

➝This is the core of a solid Monthly budget plan.

➤Account 2: The Future Foundation (Savings)

➝This account is strictly for a Student savings account and should be harder to access.

➝It’s where the Emergency fund lives, tucked away for those unexpected laptop repairs or medical needs.

➝Focusing on Savings early helps build a safety net that most peers won't have.

➝Think of this as the vault; money goes in, but it rarely comes out.

➤Account 3: The Freedom Fund (Personal Spending)

➝This is the "guilt-free" zone for hanging out, movies, or hobbies.

➝It allows for enjoyment without ruining the overall Financial planning goals.

➝Once this account is empty, the fun stops until the next month.

| Account Type | Primary Purpose | Suggested Percentage |

|---|---|---|

| Expenses Account | Living essentials and bills | 50 percent |

| Savings Account | Emergencies and long-term goals | 30 percent |

| Freedom Account | Leisure and personal treats | 20 percent |

Building a Smarter Financial Routine

The transition from just spending to actual Financial literacy happens when one starts tracking the movement of money. It is important to look at Student finance as a skill rather than a chore. Developing smart money habits while still in college sets the stage for a much easier transition into adulthood.

➤Setting up Automatic Transfers

➝Automation is a lifesaver for anyone who forgets to save.

➝Schedule a transfer to the savings account the moment any Income hits.

➝Treat the savings goal like a mandatory bill that must be paid to your future self.

➝This ensures that Wealth building starts immediately, even with small amounts.

➤Understanding the flow of money

➝Use simple apps or spreadsheets to track where the Cash flow goes.

➝Identify "money drains" like unused gym memberships or excessive takeout.

➝Adjust the Budgeting strategy every month based on actual spending patterns.

➝Reviewing how having 3 bank accounts can improve your personal finance can provide a deeper look at the psychological benefits of this split.

| Monthly Task | Description | Time Required |

|---|---|---|

| Budget Review | Check last month's spending vs. reality | 15 Minutes |

| Goal Setting | Decide on a specific savings target | 5 Minutes |

| Subscription Audit | Cancel anything not being used | 10 Minutes |

Long Term Growth and Wealth

While it feels like college is just about surviving the week, it is actually the best time to think about investment opportunities. Because of the power of compounding, even a tiny amount invested now grows significantly over a decade. Mastering Personal finance early means having more options later in life.

➤Staying out of the Debt trap

➝Avoid high-interest Debt like credit cards or "Buy Now, Pay Later" schemes.

➝If money isn't in the Freedom Fund, the item isn't affordable yet.

➝Learning to delay gratification is a core part of rich and successful careers start with these 3 student habits.

➝Prioritizing needs over wants prevents a cycle of financial stress.

➤Learning the Ropes

➝Take advantage of free resources like financial literacy compile file to understand complex terms.

➝Explore government initiatives like PMJDY for accessible Banking options.

➝Building these skills is why career counsellors prioritize these 3 skills for student success during their guidance sessions.

➝You can also find practical online courses to sharpen your understanding of Personal finance tips.

| Investment Level | Risk Factor | Focus Area |

|---|---|---|

| Beginner | Low | Savings accounts and Fixed Deposits |

| Intermediate | Moderate | Index funds or Mutual funds |

| Advanced | High | Individual stocks or Business ventures |

Frequently Asked Questions

Q1. Is it expensive to maintain three different accounts?

Ans. Not necessarily. Many Bank accounts for students offer zero-balance or low-minimum-balance features. It is best to look for banks that waive fees for those under 25 or for students with valid IDs.

Q2. How much should I put into my Emergency fund?

Ans. A good starting goal is to have enough to cover at least one to two months of basic expenses. This provides a buffer if a part-time job is lost or an unexpected cost arises.

Q3. Can I use digital wallets instead of actual bank accounts?

Ans. While digital wallets are great for budgeting small daily costs, they don't always offer the same security or interest benefits as a regulated Banking institution. Using them as a sub-category of your Freedom Fund is a better approach.

Q4. What if my income is very low and inconsistent?

Ans. The 3-account system is even more important for low incomes. It ensures that the most vital bills are paid first. Even if you only put 10 rupees into a Student savings account, it builds the habit of Wealth building and discipline.

Q5. When should I start thinking about an Investment?

Ans. Once an Emergency fund is fully funded and there is no high-interest Debt, it is a great time to start. Small, regular contributions are better than waiting for a large sum of money to start your Financial planning journey.